Risk Factors in Mutual Funds

Mutual funds provide easy access to financial markets and professional management, but they are not risk-free. To make informed decisions, investors must understand the different types of risk factors in mutual funds that can impact their investments. Recognizing these risks can help in Portfolio Diversification, risk mitigation, and strategic investment planning. Lets understand the types of Mutual Fund risks:-

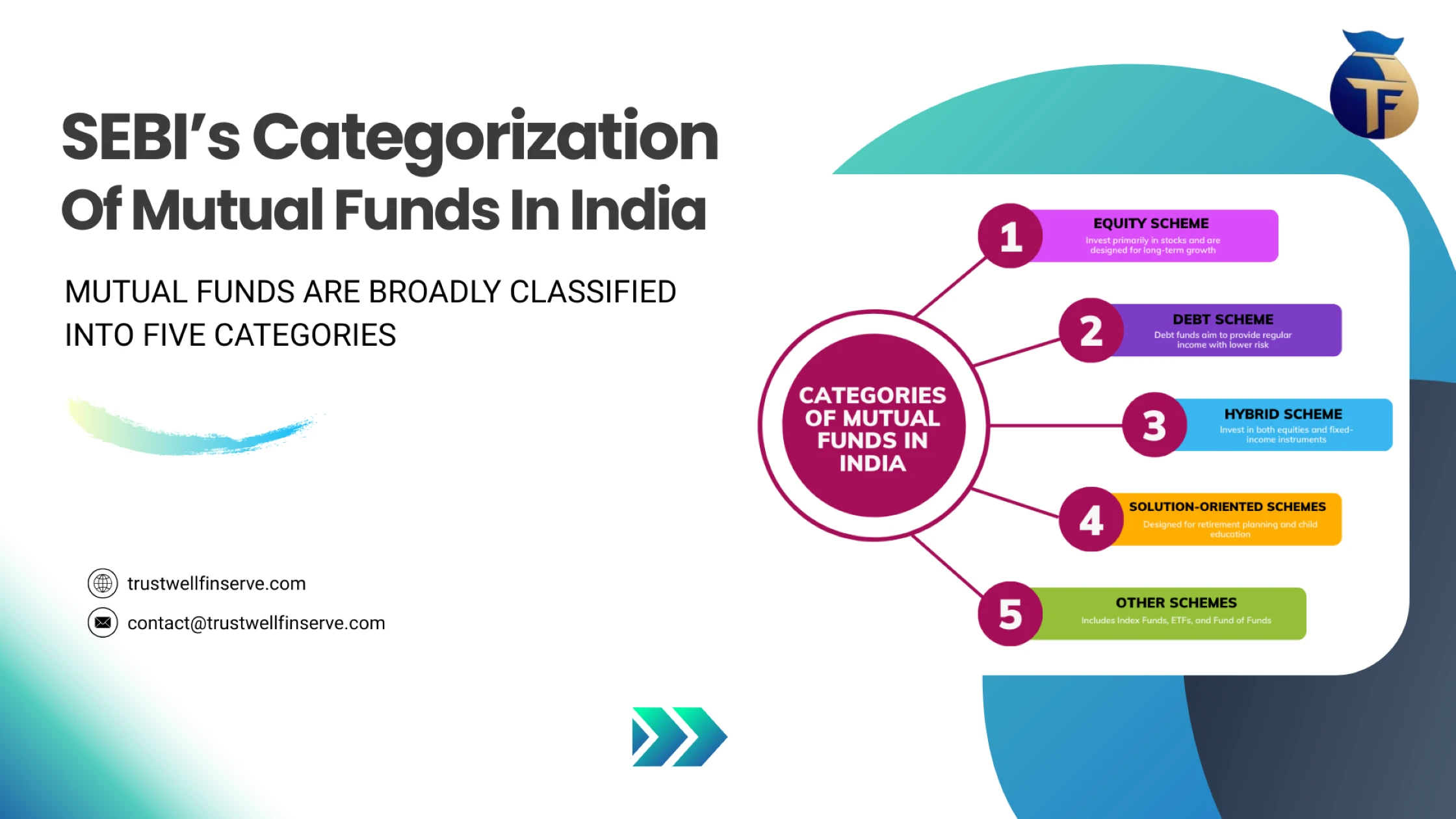

1. Standard Risk Factors (Common to most mutual funds)

These risk factors apply broadly to mutual funds across asset classes—equity, debt, hybrid, and others:

i. Market Risk

Market Risk factors refers to potential losses due to overall market movements caused by macroeconomic events, geopolitical tensions, Inflation, or changes in interest rates. For example, during the 2008 financial crisis, stock markets worldwide plunged, affecting mutual fund investors across asset classes.

How to mitigate:

- Invest across multiple asset classes to diversify exposure.

- Stay invested for the long term to ride out market Volatility.

ii. Liquidity Risk

Liquidity risk occurs when a fund struggles to sell its Holdings quickly enough to meet Redemption requests. This problem is especially relevant during market crashes, when selling Securities without incurring significant losses becomes difficult.

For instance, Small-Cap funds often face liquidity issues, as these stocks may have lower trading volumes compared to Large-Cap stocks.

How to mitigate:

- Avoid funds investing in thinly traded securities.

- Ensure the fund’s portfolio has highly liquid assets.

iii. Inflation Risk

Inflation reduces the purchasing power of money, meaning that if your mutual fund’s returns do not exceed inflation, you might lose real value over time.

Example: If inflation is 6% per year and your mutual fund generates 5% annual returns, your investment is technically losing purchasing power.

How to mitigate:

- Invest in funds with historically strong real returns (returns adjusted for inflation).

- Consider equity-oriented funds or inflation-protected debt instruments.

iv. Expense Risk

Expense risk refers to the impact of fund management fees, distribution charges, and other costs on returns. Higher fees reduce your final gains.

Example: If a fund charges an Expense Ratio of 2%, your returns will be lower compared to a fund with a 1% expense ratio, assuming both generate the same gross returns.

How to mitigate:

- Choose funds with a competitive expense ratio (lower fees = higher net returns).

- Consider Index Funds, which generally have lower expense ratios than actively managed funds.

v. Manager Risk

A fund’s performance depends on the skill, strategy, and decisions of the Fund Manager. If they make poor investment choices or frequently change strategies, returns can suffer.

Example: A manager heavily investing in a single sector, assuming it will perform well, can expose investors to excessive risk.

How to mitigate:

- Research the fund manager’s track record and investment philosophy before investing.

- Prefer funds with stable leadership and consistent investment strategies.

vi. Operational and Compliance Risk

This risk arises from fund mismanagement, fraud, operational inefficiencies, or non-compliance with regulations.

Example: In 2018, certain mutual funds suffered losses due to investments in risky corporate debt, which later defaulted. This led to investor panic and regulatory scrutiny.

How to mitigate:

- Invest in funds from reputable fund houses with strong governance policies.

vii. Concentration Risk

Occurs when a fund is overly exposed to a particular sector, theme, or company. If that segment suffers losses, the fund’s value drops significantly.

Example: A fund heavily invested in technology stocks during the dot-com bubble suffered significant losses when tech stocks crashed.

How to mitigate:

- Choose Diversified funds rather than sector-specific funds for better risk management.

viii. Style Drift Risk

Happens when a fund deviates from its stated investment style, leading to unexpected risks for investors.

Example: A fund originally classified as a large-cap fund may start investing in Mid-Cap stocks without informing investors, changing its risk profile.

How to mitigate:

- Regularly check fund holdings and strategy updates.

Of course, Ajay! Let’s expand on these sections with more detail, examples, and risk management strategies.

2. Risks Associated with Investments in Equities

Equity mutual funds primarily invest in stocks, offering the potential for high returns. However, they come with significant risks due to market volatility, corporate performance, and sector-specific challenges.

i. Equity Market Risk

This refers to the overall risk that stock prices will fluctuate due to changes in economic growth, interest rates, inflation, government policies, and investor sentiment.

How to mitigate:

- Stay invested for the long term rather than trying to time the market.

- Diversify across different asset classes (Equities, debt, gold, etc.) to reduce exposure.

ii. Company-Specific Risk

Also called idiosyncratic risk, this refers to risks tied to individual companies held in a mutual fund. Issues like fraud, governance failures, mismanagement, poor financials, or legal troubles can impact stock prices, negatively affecting fund returns.

How to mitigate:

- Invest in funds that follow strong fundamental research before selecting stocks.

- Ensure fund managers apply risk management frameworks while investing.

iii. Sector/Industry Risk

If a fund is concentrated in a particular sector (e.g., technology, pharma, banking, or energy), poor performance in that sector can heavily impact returns.

How to mitigate:

- Choose diversified equity funds rather than sector-specific funds.

- Track cyclical industries to understand when sectors perform better.

iv. Currency Risk (for international funds)

Funds that invest in overseas equities face the risk of foreign exchange rate fluctuations affecting returns. If the domestic currency strengthens, it lowers the value of investments made in foreign currencies.

How to mitigate:

- Invest in hedged international funds to protect against currency movements.

- Understand country-specific economic trends before investing globally.

Want to know you risk profile? Use our Risk Profiler – Assess Your Risk Profile for Investments

3. Risks Associated with Investment in Debt Securities and Money Market Instruments

Debt mutual funds invest in government bonds, corporate debentures, commercial paper, and treasury bills, offering relative stability. However, they carry their own risk factors tied to interest rates, creditworthiness, and reinvestment challenges.

i. Interest Rate Risk

Bond prices move inversely to interest rates. When rates rise, bond prices fall, affecting long-duration debt funds significantly.

Example:

- If RBI hikes interest rates to curb inflation, existing bond prices fall since new bonds offer higher yields.

How to mitigate:

- Invest in short-duration or floating-rate debt funds during rising rate periods.

ii. Credit Risk

Some bonds have a risk of default, meaning the bond issuer may not repay debt obligations. Lower-rated bonds carry higher default risk, leading to Capital Loss.

How to mitigate:

- Invest in funds holding AAA-rated government and corporate bonds.

- Review the Credit Rating and financial health of bond issuers.

iii. Spread Risk

The difference between government bond yields and Corporate Bond yields impacts valuations. If corporate bonds become riskier, investors demand higher yields, lowering bond prices.

Example:

- During economic uncertainty, investors prefer government bonds, increasing corporate bond risk spreads.

How to mitigate:

- Diversify holdings between corporate and government debt.

iv. Reinvestment Risk

When bonds mature or pay interest, reinvesting those proceeds at lower rates in a declining interest environment reduces future returns.

Example:

- If an investor receives coupon payments from bonds during falling rates, they may earn lower interest when reinvesting.

How to mitigate:

- Invest in laddered bond portfolios, where maturities are staggered over different timeframes.

v. Prepayment Risk

Applies to mortgage-backed securities, where borrowers repay loans early, affecting expected returns for fund investors.

Example:

- In a falling rate environment, people refinance home loans at lower rates, reducing expected returns for funds holding mortgage-backed securities.

How to mitigate:

- Prefer funds with stable cash flow investments.

Final Thoughts

Both equity and debt mutual funds carry risks, but by understanding these risk factors, investors can make better decisions.

✔️ For equity risks, focus on long-term investments and sector diversification.

✔️ For debt risks, monitor interest rates, credit ratings, and reinvestment strategies.

✔️ Always match funds to your Risk Tolerance and financial goals.

Disclaimer: The content on this blog is intended solely for educational purposes. All investment and financial planning strategies discussed are subject to market conditions and other factors beyond our control. Any securities or investments mentioned are not to be taken as recommendations or endorsements. Readers are encouraged to consult with a qualified Financial Advisor before making any investment decisions.