Understanding your investment’s real potential is key to better financial decisions. The Internal Rate of Return (IRR) is one of the most powerful tools to help you analyze investment performance over time. With our online IRR Calculator, you can effortlessly evaluate returns on various investment options, from mutual funds to business ventures and Real Estate.

IRR Calculator

General IRR Calculator

Return Multiple IRR Calculator

Fixed Cash Flow IRR Calculator

In the final period, along with my periodic cash flow

I shall receive my initial investment

Custom Cash Flows IRR Calculator

| Enter your yearly cash flows: | ||

|

₹

|

|

|

|

₹

|

|

|

|

₹

|

|

|

|

₹

|

|

|

What is IRR (Internal Rate of Return)?

IRR is the annualized rate at which the net present value (NPV) of all cash flows (inflows and outflows) from an investment becomes zero. It is widely used to:

- Compare different investment opportunities

- Understand the profitability of a project or asset

- Make better long-term financial decisions

In simple terms, IRR tells you the effective annual return your investment is expected to generate.

How Can an IRR Calculator Help You?

Using an IRR calculator simplifies complex return calculations by:

- Automating time value of money calculations

- Comparing projects with irregular cash flows

- Making informed decisions without manual spreadsheet work

Whether you’re an investor, Financial Advisor, or business owner, the IRR calculator can help you measure true profitability with precision.

How Does the IRR Calculator Work?

The IRR Calculator requires you to enter:

- Initial Investment (Outflow): The amount invested at the beginning.

- Future Cash Inflows: Regular or irregular income from the investment.

- Dates of Each Cash Flow: Exact dates help in accurate calculation.

- Final Value (if any): The maturity or exit value of the investment.

The calculator uses these values to determine the IRR using a numerical iteration process, which cannot be solved by a simple formula.

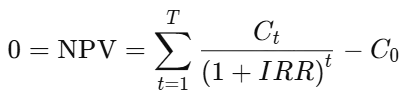

IRR Formula (Conceptual)

IRR solves this equation:

Where:

- C0 is the initial investment (a negative value indicating cash outflow).

- Ct represents the net cash inflow during the period t.

- t is the number of time periods.

- IRR is the Internal Rate of Return.

Since this equation is nonlinear, solving it requires trial and error or computational algorithms, which the calculator handles for you.

You can also calculate XIRR from our XIRR Calculator.

Example of IRR Calculation

Let’s say you invested ₹1,00,000 and received the following returns:

| Date | Cash Flow (₹) |

|---|---|

| Jan 2022 | -1,00,000 |

| Jan 2023 | +30,000 |

| Jan 2024 | +40,000 |

| Jan 2025 | +50,000 |

Using the IRR calculator, the internal rate of return will be approximately 16.45% per annum.

Advantages of Using Our Online IRR Calculator

- Saves time and avoids complex Excel formulas

- Works for uneven and multiple cash flows

- Ideal for evaluating real estate, startups, mutual funds, and SIPs

- Helps you compare multiple investments on a uniform scale

How to Use Our IRR Calculator?

Our IRR calculator is designed to be user-friendly, catering to various scenarios. Here’s a step-by-step guide to using it:

- General IRR: Input your initial investment, final amount, and the investment period in years and months. Click “Calculate IRR” to determine your annual return.

- Return Multiple: Enter the return multiple and the investment duration to instantly get your IRR.

- Fixed Cash Flows: Provide your initial investment, expected recurring cash flow, frequency, and duration. The calculator will factor in the final payout and compute the IRR.

- Custom Cash Flows: Add your initial investment and list each cash flow individually, marking them as inflows or outflows. You can easily add or remove entries to match your scenario.

Limitations of IRR

- May be misleading if used on non-conventional cash flows

- Does not consider reinvestment rate of interim cash flows

- Might show multiple IRRs if cash flow signs change more than once

Hence, IRR should be used along with other metrics like NPV or XIRR for a complete analysis.

Conclusion

An IRR calculator is an indispensable tool for anyone who wants to evaluate real investment performance—not just guess at it. It’s especially helpful when dealing with irregular cash flows over time.

Use our easy and accurate IRR Calculator today to take control of your financial planning and investment analysis!

You can also calculate EMI from our EMI Calculator.

Disclaimer: The content on this blog is intended solely for educational purposes. The results produced by the calculator or calculators are merely indicative and intended for informational reasons.

Under no circumstances should these calculators be regarded as financial, Investment or professional advice from Trustwell Finserve (“TWF”), nor are they intended to offer users certified results from TWF or to act as an obligation, guarantee, warranty, undertaking, or commitment. They are only instruments to assist users in analyzing different illustrative situations according to the information they enter. These calculators are used at the user’s own risk, and TWF assumes no liability for any mistakes, inaccuracies, or results that may result from using them.