Mutual Funds for Beginners Guide

Are you thinking about stepping into the world of investments? Mutual funds are an excellent place to begin. They offer simplicity, Diversification, and professional management — perfect for anyone new to investing. But like any journey, you need a guide to navigate the path confidently.

This comprehensive Mutual Funds for Beginners Guide lays out three clear paths to get started — Learn, Plan, or Invest — depending on your current knowledge and comfort level.

Choose Your Starting Point

✅ I Want to Learn

Start by understanding how mutual funds work, the terminology, and the core benefits. If you’re new and want to build foundational knowledge before taking action, this is your starting point.

✅ I Want to Plan

If you’re familiar with the basics and ready to align your investments with your life goals, begin by creating a tailored investment plan based on your risk appetite and Time Horizon.

✅ I Want to Invest

Already confident and ready to begin your journey? Skip the prep and jump straight into investing with the right fund choice and investment method.

No matter where you begin, this guide will help you understand, prepare, and move forward with smart investment decisions.

Part 1: Learning the Fundamentals of Mutual Funds

Before you invest, it’s crucial to understand what mutual funds are and how they function. Here’s what every beginner should know:

1. What Are Mutual Funds?

Mutual funds pool money from multiple investors to create a large corpus, which is then invested in a Diversified Portfolio of assets like Equities, debt instruments, or a mix of both. These funds are managed by expert fund managers, making investing easier for those who don’t want to directly track markets or manage individual stocks.

2. Key Benefits of Mutual Funds

- Professional Management: Managed by experienced fund managers.

- Diversification: Spreads your investment across assets to reduce risk.

- Liquidity: Open-ended mutual funds can be bought or sold on any business day.

- Flexible Options: From high-growth equity funds to stable debt funds, there’s something for every investor type.

3. Understanding NAV (Net Asset Value)

NAV is the per-unit price of a Mutual Fund and reflects its current market value. It’s calculated as:

NAV = (Assets – Liabilities) / Outstanding Units

Tracking NAV helps you evaluate fund performance over time.

🔗 Check the Latest Mutual Fund NAVs on Our Page

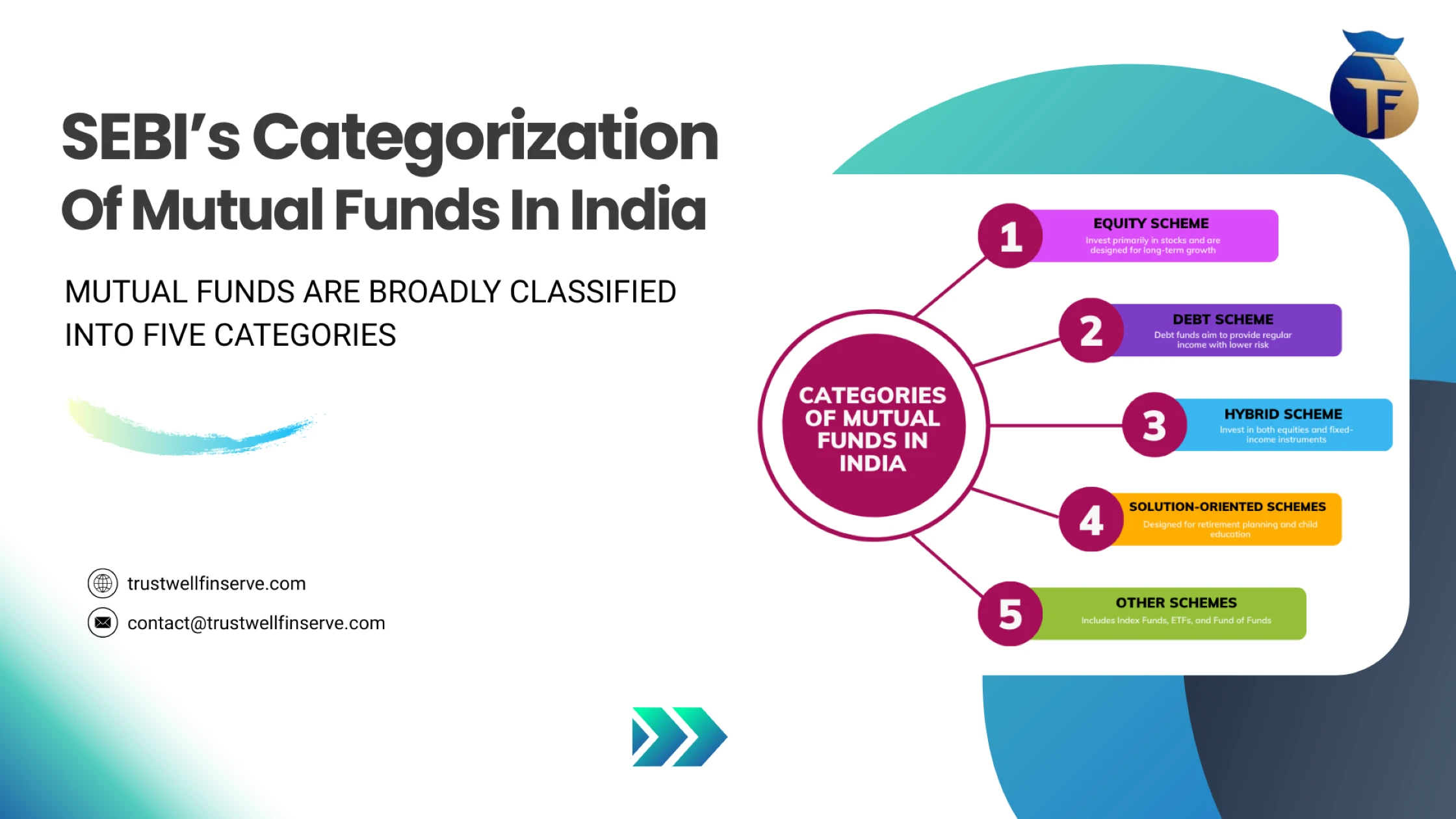

4. Types of Mutual Funds

- Equity Funds – Invest in stocks for long-term growth.

- Debt Funds – Invest in fixed-income Securities for steady returns.

- Hybrid Funds – Combine equity and debt to balance risk and return.

- ELSS Funds – Tax-saving funds under Section 80C of the Income Tax Act.

- Sectoral Funds – Focused on specific industries like tech, pharma, etc.

🔗 Want to dive deeper? Read our full post on SEBI Categorization Of Mutual Funds In India

5. What is SIP (Systematic Investment Plan)?

SIP allows you to invest a fixed amount at regular intervals (e.g., monthly). It instills financial discipline, uses the power of compounding, and leverages rupee-cost averaging to manage market Volatility.

6. Investment Strategies

- SIP: Great for gradual Wealth creation.

- Lump Sum: Ideal when you have a large sum and want to invest it all at once for specific goals.

7. Understanding Risk and Return

All investments carry some risk. Equity funds might offer higher returns but are volatile, while debt funds offer more stability with moderate returns. Choose based on your comfort with risk.

🔗 Want to dive deeper? Read our full post on Basics of Mutual Funds

Part 2: Planning Your Mutual Fund Investment

Planning helps align your investments with your life goals. Start by evaluating your current financial status, future aspirations, and risk profile.

Step-by-Step Investment Planning:

- Set Clear Financial Goals: Identify whether you’re saving for retirement, a home, children’s education, or wealth creation.

- Assess Your Risk Appetite: Are you a conservative, moderate, or aggressive investor? Your fund choices should reflect this.

- Decide on the Fund Type:

- For long-term growth: Equity funds

- For stability: Debt funds

- For tax Savings: ELSS

- For balance: Hybrid funds

Proper planning helps you stay committed, even during market fluctuations, and ensures your investments work toward your desired outcomes.

🔗 Also Read our full post on Risk Factors in Mutual Funds

Part 3: Investing in Mutual Funds

If you’re ready to take action, here’s how to start your mutual fund investment journey:

Reasons to Start Investing Today

- Save on Taxes

ELSS funds offer tax deductions under Section 80C while helping grow your wealth. - Earn Better Returns Than Savings Accounts and FDs

Debt mutual funds generally offer higher returns than fixed deposits, with comparable risk — a good option for short- to medium-term goals. - Build Long-Term Wealth

Equity funds allow you to participate in the growth of markets and sectors, offering substantial returns over the long haul.

How to Start Investing in Mutual Funds

- Choose Between SIP or Lump Sum

- SIP: Ideal for regular monthly investing

- Lump Sum: Useful when you have a one-time amount to invest

- Pick the Right Fund

Based on your plan and goals, select from equity, debt, hybrid, or ELSS categories. - Start with a Trusted Platform

Open a mutual fund account through a reliable platform, submit your KYC details, and begin your journey. - Automate and Review

Automate your SIPs for consistency and monitor performance periodically to ensure alignment with your goals.

Your Journey Starts Here: Learn, Plan, or Invest

Wherever you stand today—whether you’re just starting to explore, building a solid plan, or ready to invest—this Mutual Funds for Beginners Guide is here to support you every step of the way.

- Learning gives you the confidence to make informed decisions.

- Planning ensures your investments are aligned with your goals.

- Investing is the action that turns intent into results.

Start now and take control of your financial future with smart, goal-oriented investing.

Disclaimer: The content on this blog is intended solely for educational purposes. All investment and financial planning strategies discussed are subject to market conditions and other factors beyond our control. Any securities or investments mentioned are not to be taken as recommendations or endorsements. Readers are encouraged to consult with a qualified Financial Advisor before making any investment decisions.