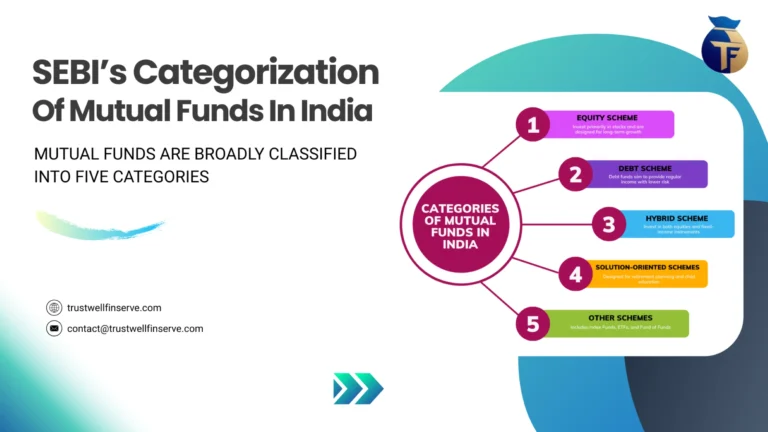

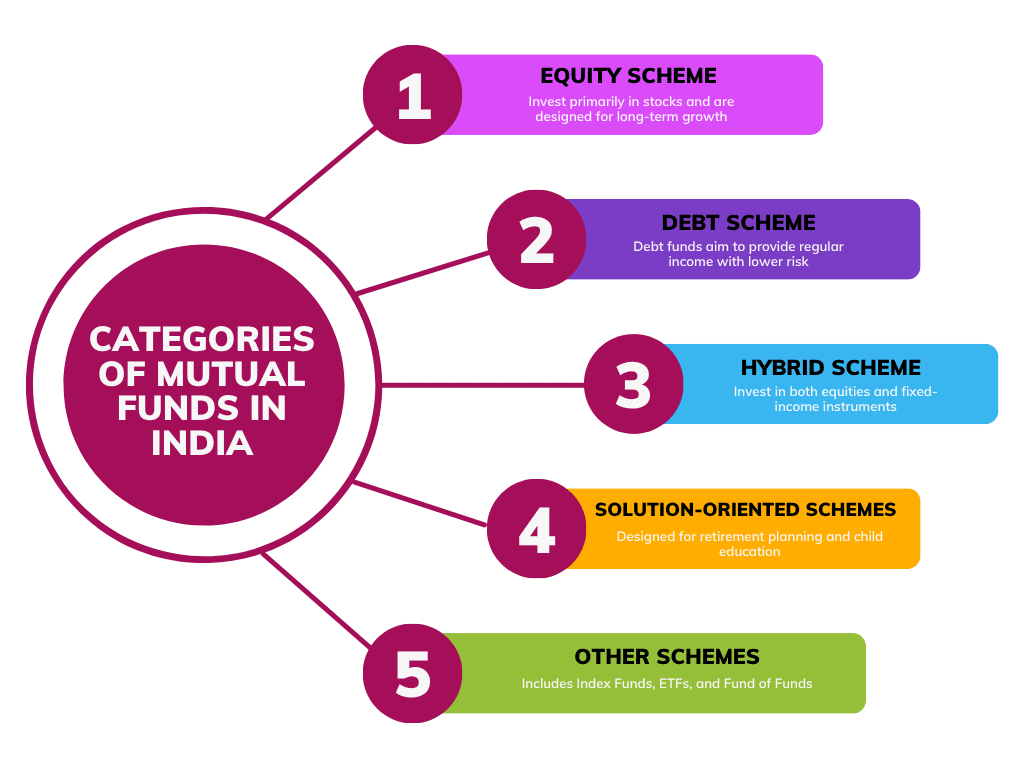

SEBI’s Categorization of Mutual Fund Schemes

In accordance with the SEBI guidelines on Categorization and Rationalization of Mutual Fund Schemes, issued in October 2017, mutual funds are classified into the following categories:

- Equity Schemes

- Debt Schemes

- Hybrid Schemes

- Solution-Oriented Schemes – Designed for retirement planning and child education

- Other Schemes – Includes Index Funds, ETFs, and Fund of Funds

Key updates under these guidelines include:

- Equity Categories Defined: Large, Mid, and Small-Cap stocks now have clearly outlined classifications.

- Scheme Naming Conventions: Especially for debt schemes, names are revised to reflect the risk level of the underlying Portfolio (e.g., “Credit Opportunity Fund” is now termed “Credit Risk Fund”).

- Hybrid Fund Subcategories: Hybrid Funds are further classified into Conservative Hybrid Fund, Balanced Hybrid Fund, and Aggressive Hybrid Fund, offering investors differentiated risk-return profiles.

This refined structure aims to bring greater transparency and consistency to mutual fund offerings.

1. Equity Schemes

An equity scheme is a mutual fund that:

- Primarily invests in Equities and equity-related instruments.

- Aims for long-term growth, though it may experience short-term Volatility.

- Is suitable for investors with a higher risk appetite and a longer investment horizon.

The primary objective of equity funds is long-term Capital Appreciation. These funds may focus on specific market sectors or follow particular investment styles, such as value or Growth Investing.

Equity Fund Categories (As per SEBI Guidelines)

The SEBI Categorization and Rationalization framework classifies equity funds into various categories based on investment strategy and stock allocation:

| Category | Minimum Investment Allocation |

|---|---|

| Multi Cap Fund* | At least 75% in equity & related instruments |

| Flexi Cap Fund | At least 65% in equity & related instruments |

| Large Cap Fund | At least 80% in Large-Cap stocks |

| Large & Mid Cap Fund | At least 35% in large-cap stocks and 35% in Mid-Cap stocks |

| Mid Cap Fund | At least 65% in mid-cap stocks |

| Small Cap Fund | At least 65% in small-cap stocks |

| Dividend Yield Fund | Primarily invests in dividend-yielding stocks, with at least 65% allocated to equities. |

| Value Fund | Follows a value investment strategy, investing at least 65% in equities. |

| Contra Fund | Adopts a contrarian approach, allocating at least 65% to equities. |

| Focused Fund | Limits Holdings to a maximum of 30 stocks, maintaining at least 65% in equity investments. |

| Sectoral/Thematic Fund | Invests at least 80% in stocks within a specific sector or theme. |

| ELSS (Equity Linked Savings Scheme) | Invests at least 80% in equities, complying with ELSS guidelines (2005), as notified by the Ministry of Finance. |

*Multi Cap Funds are also referred to as Diversified Equity Funds, as they invest across various sectors and market segments, reducing concentrated risk exposure.

Sectoral Funds

Sectoral funds focus on a specific sector of the economy, such as infrastructure, banking, technology, or pharmaceuticals.

- Since these funds concentrate on a single sector, they limit Diversification, making them riskier than broad-based equity funds.

- Investment timing is crucial, as sector performance tends to be cyclical, requiring strategic entry and exit points.

Examples of Sector-Specific Equity Funds:

- Pharma & Healthcare Sector

- Banking & Finance Sector

- FMCG (Fast Moving Consumer Goods) and related sectors

- Technology and related sectors

Thematic Funds

Thematic funds invest in companies within a broader theme, rather than a single sector. This makes them more diversified than sectoral funds, reducing risk exposure.

Common themes include:

- Infrastructure

- Service industries

- Public Sector Undertakings (PSUs)

- Multinational Corporations (MNCs)

Value Funds (Strategy and Style Based Funds)

Funds that invest in undervalued stocks with strong growth potential.

- Growth Funds – Target momentum stocks expected to outperform the market.

- Value Funds – Focus on stocks trading below intrinsic value, aiming for long-term returns as their true worth is realized.

- Value funds often hold a concentrated portfolio, which can heighten risk—wrong stock selection can significantly impact performance.

Contra Funds

Contra funds take a contrarian approach, investing in underperforming stocks at low price points, betting on future recovery.

- Portfolios include defensive and beaten-down stocks that struggled in bear markets.

- These funds carry higher risk, as timing market trends before the mainstream is unpredictable.

- Typically, contra funds underperform in bull markets due to their defensive positioning.

- As per SEBI guidelines, fund houses can offer either a Contra Fund or a Value Fund—not both.

Equity Linked Savings Scheme (ELSS)

ELSS is a tax-saving mutual fund that:

- Invests at least 80% in equities, following the Equity Linked Saving Scheme (2005), notified by the Ministry of Finance.

- Has a lock-in period of 3 years—the shortest among tax-saving options.

- Is eligible for tax deduction under Section 80C of the Income Tax Act up to ₹1,50,000.

2. Debt Schemes

A debt fund (also known as an Income Fund) primarily invests in bonds or other debt Securities, offering investors capital preservation and steady income generation.

Debt funds include investments in short-term and long-term securities issued by:

- Government (Treasury Bills, Government Securities)

- Public financial institutions

- Corporates (Debentures, Commercial Paper, Certificates of Deposit)

Classification of Debt Funds

Debt funds can be categorized based on:

- Tenor of the securities (investment duration)

- Short-term funds

- Medium-term funds

- Long-term funds

- Issuer types and fund management strategy

- Gilt Funds

- Treasury Funds

- Corporate Bond Funds

- Infrastructure Debt Funds

- Specialized Strategies

- Floating Rate Funds

- Dynamic Bond Funds

- Fixed Maturity Plans

SEBI Categorization of Debt Funds

SEBI’s framework for debt fund classification ensures transparency and consistency in investment objectives.

| Fund Category | Investment Focus |

|---|---|

| Overnight Fund | Securities maturing in 1 day |

| Liquid Fund | Debt & money market securities maturing within 91 days |

| Ultra Short Duration Fund | Instruments with Macaulay duration between 3–6 months |

| Low Duration Fund | Instruments with Macaulay duration between 6–12 months |

| Money Market Fund | Money market instruments with maturity up to 1 year |

| Short Duration Fund | Debt & money market instruments with Macaulay duration of 1–3 years |

| Medium Duration Fund | Debt & money market instruments with Macaulay duration of 3–4 years |

| Medium to Long Duration Fund | Instruments with Macaulay duration of 4–7 years |

| Long Duration Fund | Instruments with Macaulay duration greater than 7 years |

| Dynamic Bond Fund | Flexible across different duration categories |

| Corporate Bond Fund | Minimum 80% allocation in AA+ and above rated corporate bonds |

| Credit Risk Fund | Minimum 65% in AA and below rated corporate bonds |

| Banking & PSU Fund | Minimum 80% in debt instruments of banks, PSUs, financial institutions, and municipal bonds |

| Gilt Fund | Minimum 80% in government securities (G-secs) across maturities |

| Gilt Fund with 10-Year Constant Duration | Minimum 80% in G-secs, maintaining a portfolio Macaulay duration of 10 years |

| Floater Fund | Minimum 65% in floating rate instruments, including fixed-rate bonds converted to floating rate exposure using swaps/Derivatives |

Specialized Debt Fund Strategies

- Dynamic Bond Funds – Adjust portfolio tenor based on Interest Rate expectations (increase tenor if rates are expected to fall and vice versa).

- Floating Rate Funds – Invest in bonds with periodically resetting interest rates, helping align coupon income with current market rates and reducing interest rate risk.

Short-Term Debt Funds

The primary objective of short-term debt funds is to generate coupon income while managing risk. These funds must be evaluated for credit risk, as higher-yielding investments may carry increased risk.

Key considerations:

- Funds investing in lower tenor securities typically have lower risk and lower returns.

- Liquid funds invest in securities maturing within 91 days to ensure Liquidity and stability.

- Ultra Short-Term Debt Funds maintain a portfolio with a slightly longer tenor, allowing for higher coupon income.

- Short-Term Funds combine short-term debt holdings with some long-term securities, benefiting from potential price appreciation.

Fixed Maturity Plans (FMPs)

FMPs are closed-ended funds designed to eliminate interest rate risk and lock in yields by investing in securities matching the fund’s maturity.

Key Features of FMPs

- Portfolio maturity matches fund tenor, ensuring predictable returns.

- Potential for higher yields compared to Liquid & Ultra Short-Term Funds due to locked-in investments.

- Low mark-to-Market Risk, as assets are liquidated at maturity.

- Investors must commit funds for a fixed period, with no premature Redemption.

- Mandatory Stock Exchange listing – units can be bought or sold only after the NFO.

- Demat account required for trading FMP units.

3. Hybrid Funds

Hybrid funds invest in a mix of equities and debt securities to strike a balance between growth and income.

Key Features:

- Debt instruments provide stability, ensuring more predictable returns.

- The allocation between equity and debt is outlined in the Scheme Information Document (SID).

- Aggressive Hybrid Funds (equity-oriented) suit investors seeking growth with moderate stability.

- Conservative Hybrid Funds (debt-oriented) are ideal for low-risk investors who want enhanced returns with minimal equity exposure.

- Risk and return depend on equity allocation—higher equity exposure means greater volatility and potential growth.

SEBI Classification of Hybrid Funds

SEBI has categorized hybrid funds into seven types, each with distinct investment mandates:

| Fund Type | Equity Allocation | Debt Allocation |

|---|---|---|

| Conservative Hybrid Fund | 10%–25% | 75%–90% |

| Balanced Hybrid Fund | 40%–60% | 40%–60% |

| Aggressive Hybrid Fund | 65%–80% | 20%–35% |

| Dynamic Asset Allocation / Balanced Advantage Fund | 0%–100% (managed dynamically) | 0%–100% (managed dynamically) |

| Multi Asset Allocation Fund | Invests in at least 3 asset classes, with minimum 10% allocated to each | |

| Arbitrage Fund | Minimum 65% in equity & equity-related instruments, following an arbitrage strategy | |

| Equity Savings Fund | Minimum 65% in equity, 10% in debt, and derivatives for hedging (specified in SID) | |

Capital Protection Oriented Funds

These are closed-ended hybrid funds designed to preserve capital while offering growth potential through equity derivatives.

Structure & Key Features

- Debt portion is invested in highest-rated instruments for stability.

- A portion of investor funds is allocated to debt instruments, maturing at the initial capital value to ensure capital protection.

- Equity derivatives provide the potential for higher returns.

- The portfolio is credit-rated quarterly to ensure the fund’s ability to maintain capital protection.

Multi-Asset Funds

Multi-asset funds provide diversified exposure to multiple asset classes, offering a balance between risk and reward.

- Investments may include equities, fixed income instruments, Index funds, financial derivatives, and Commodities like gold.

- This broad diversification allows fund managers to deliver steady, long-term returns, particularly in volatile markets.

Arbitrage Funds

Arbitrage funds exploit price differentials between two markets to generate returns.

- These funds buy stocks in the cash market and simultaneously sell them in the futures market at a higher price.

- The fund holds equal but opposite positions in both markets, locking in the price difference.

- Profits are realized upon expiry of the derivative cycle, as cash prices converge with futures prices.

- Since price movements do not affect the initial differential, risk is minimized, making arbitrage funds a suitable choice for cautious investors navigating volatile markets.

4. Solution-Oriented Schemes

These funds cater to specific financial goals, such as retirement planning and child education, or tracking market indices.

- Retirement Fund – Lock-in for at least 5 years or until retirement age, whichever is earlier.

- Children’s Fund – Lock-in for at least 5 years or until the child reaches adulthood, whichever is earlier.

5. Other Schemes

- Index Funds / ETFs – Minimum 95% invested in securities replicating a specific index.

- Fund of Funds (Domestic/Overseas) – Minimum 95% invested in underlying mutual funds.

Index Funds

Index funds replicate the portfolio of a specific market index to provide returns that match index performance.

- Securities and their weighting mirror the index composition.

- The fund does not actively rebalance based on market views.

- Passively managed, with minimal portfolio adjustments.

- Expense Ratio capped at 1.5%, ensuring cost-efficiency.

- Investors benefit from predictability, as index composition is publicly available.

Exchange-Traded Funds (ETFs)

ETFs are marketable securities that track an index, commodity, or asset basket.

- Traded on stock exchanges, with prices fluctuating throughout the day.

- Held compulsorily in demat mode.

- Passively managed, lowering administrative costs compared to actively managed funds.

- Offers index-linked returns with liquidity similar to stocks.

Fund of Funds (FoFs)

FoFs invest in other mutual fund schemes rather than individual securities.

- Fund selection aligns with the Investment Objective of the FoF.

- Expenses are incurred at two levels—the underlying fund and the FoF itself.

- Regulatory expense caps:

- 1% for FoFs investing in liquid schemes, index funds, and ETFs.

- 2.25% for FoFs investing in equity-oriented schemes.

- 2% for all other categories.

Gold Exchange-Traded Funds (Gold ETFs)

Gold ETFs offer an electronic alternative to physical gold holdings.

- Each unit represents a defined weight of gold (typically one gram).

- Funds hold physical gold or SEBI-approved gold-related instruments.

- Up to 20% of assets can be invested in Gold Deposit Schemes of banks.

- ETF prices move in line with gold market rates.

- No Wealth tax, and taxed as non-equity mutual funds.

International Funds

International funds invest in global markets, enhancing diversification.

- Holdings may include:

- Foreign-listed equities.

- ADRs & GDRs of Indian companies.

- Debt instruments of overseas companies.

- International ETFs & index funds.

- Actively managed global funds.

- Benefits include access to global leaders, diversification beyond Indian markets, and new investment opportunities.

Risks Associated with International Funds:

- Political & macroeconomic uncertainties in foreign countries.

- Foreign exchange fluctuations impacting redemption values.

- Changing global investment policies affecting fund accessibility.

These funds Taxed as non-equity mutual funds in India.

Want to know you risk profile? Use our Risk Profiler – Assess Your Risk Profile for Investments

Disclaimer: The content on this blog is intended solely for educational purposes. All investment and financial planning strategies discussed are subject to market conditions and other factors beyond our control. Any securities or investments mentioned are not to be taken as recommendations or endorsements. Readers are encouraged to consult with a qualified Financial Advisor before making any investment decisions.