Understanding Portfolio Management Services in India (PMS)

Portfolio Management Services (PMS) are advanced investment solutions tailored for high-net-worth individuals (HNIs) and institutional investors. PMS offers personalized management of a portfolio of Securities, including stocks, bonds, and other instruments, with a focus on aligning the investments with the client’s financial objectives, risk appetite, and investment horizon.

What is PMS?

Unlike mutual funds where money is pooled from many investors, PMS offers customized portfolios for each client. This allows for greater flexibility and control in choosing assets and managing risk based on individual preferences and financial needs.

Types of Portfolio Management Services

1. Discretionary PMS

The Portfolio Manager makes all investment decisions on behalf of the client. Suitable for investors who prefer a hands-off approach.

2. Non-Discretionary PMS

The manager suggests investment opportunities, but the client retains final decision-making authority. Ideal for investors who want expert advice but maintain control.

3. Advisory PMS

The manager only provides recommendations. The client executes all transactions. Best suited for those seeking guidance but full autonomy.

Who Should Consider PMS?

PMS is best for:

- HNIs with a minimum investible corpus (usually ₹50 lakhs or more)

- Investors wanting personalized investment strategies

- Individuals seeking Diversification across asset classes

- Those who prefer professional, active portfolio management

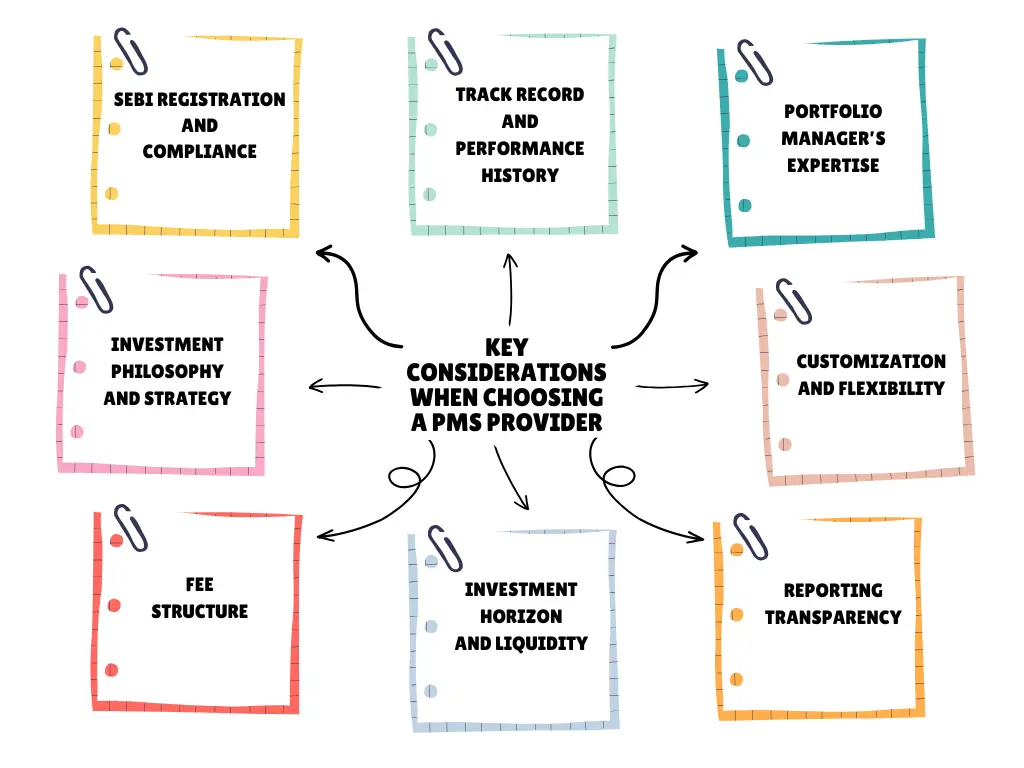

Key Factors to Consider When Choosing a PMS Provider

Selecting the right Portfolio Management Services (PMS) provider is crucial for achieving your financial goals. Here are some key factors to consider when choosing a PMS provider:

1. SEBI Registration

Verify the provider is SEBI-registered and compliant with regulations to ensure transparency and investor protection.

2. Performance Track Record

Analyze long-term returns across various market cycles and benchmark comparisons.

3. Portfolio Manager’s Experience

Evaluate the manager’s expertise, strategy, and ability to handle market fluctuations.

4. Investment Philosophy

Ensure their approach (value, growth, sector-focused, etc.) aligns with your financial goals and risk profile.

5. Customization and Flexibility

Look for tailored investment options and adaptability to changing financial needs.

6. Fee Structure

Understand management fees, entry/exit loads, and performance fees. Compare offerings across providers.

7. Liquidity and Time Horizon

PMS often involves long-term strategies. Check withdrawal rules and any lock-in conditions.

8. Transparency and Reporting

Opt for providers offering detailed, regular updates and online access to portfolio data.

Advantages of PMS

- Customized Portfolios

Tailored solutions based on your goals and risk profile. - Expert Management

Portfolios are managed by seasoned professionals. - Full Transparency

Regular performance reporting and visibility into Holdings. - Greater Flexibility

Investment in diverse instruments and strategies. - Potential Tax Efficiency

Personalized tax strategies through direct ownership.

Disadvantages of PMS

- High Entry Barrier

Typically requires a ₹50 lakh minimum investment. - Higher Costs

PMS charges can be significantly more than mutual funds. - Concentration Risk

Customization can sometimes lead to overexposure in specific stocks or sectors. - Limited Liquidity

Some PMS plans may have lock-in periods or exit restrictions.

PMS vs. Mutual Funds: A Comparison

| Feature | PMS | Mutual Funds |

|---|---|---|

| Minimum Investment | ₹50 Lakhs+ | As low as ₹100 |

| Customization | High | Limited |

| Fund Management | Individualized | Pooled |

| Transparency | Detailed Reporting |

Regulatory Oversight in India

PMS providers in India are regulated by the Securities and Exchange Board of India (SEBI). SEBI guidelines ensure that portfolio managers adhere to ethical practices, transparent disclosures, and investor-first approaches.

Who Can Offer PMS?

Only SEBI-registered entities such as:

- Wealth management firms

- Financial institutions

- Certified advisors

are authorized to offer PMS. Always choose a licensed, experienced, and aligned portfolio manager.

Is PMS the Right Choice for You?

PMS is ideal for investors:

- With significant wealth

- Looking for a bespoke investment approach

- Interested in active and professional management

However, if your needs are simple or budget is limited, mutual funds might be more suitable.

Conclusion

Portfolio Management Services (PMS) provide a Premium, personalized investment avenue for HNIs seeking strategic and active wealth management. While PMS offers numerous benefits, it also comes with higher costs and risks. Choose wisely by evaluating your financial goals, risk capacity, and the expertise of the PMS provider.

Disclaimer: The content on this blog is intended solely for educational purposes. All investment and financial planning strategies discussed are subject to market conditions and other factors beyond our control. Any securities or investments mentioned are not to be taken as recommendations or endorsements. Readers are encouraged to consult with a qualified Financial Advisor before making any investment decisions.