When evaluating investments involving multiple and irregular cash flows, the traditional IRR or ROI methods often fall short. That’s where the XIRR (Extended Internal Rate of Return) comes in.

An XIRR Calculator is an essential tool for investors who want to accurately assess returns from complex investments like SIPs, SWPs, Private Equity, and Real Estate with cash flows spread over irregular intervals.

XIRR Calculator

Custom Cash Flows XIRR Calculator

Enter your cash flows:

|

₹

|

|

|

|

|

₹

|

|

|

|

|

₹

|

|

|

|

|

₹

|

|

|

|

Fixed Cash Flow XIRR Calculator

What is an XIRR Calculator?

An XIRR Calculator computes the Extended Internal Rate of Return — the annualized return on investments that include multiple cash flows occurring at irregular intervals. It considers both the amount and exact date of each inflow/outflow, providing a more precise measurement of investment performance than a standard IRR.

How Can a XIRR Return Calculator Help You?

- Handles Irregular Dates: Accurately calculates returns when cash flows don’t follow a fixed schedule.

- Real Investment Scenarios: Useful for SIPs, SWPs, real estate, and business investments with unpredictable cash flows.

- Informed Decision-Making: Compare multiple investments based on actual performance.

- Customizable Inputs: Allows detailed inputs such as exact amounts and dates for each cash flow.

How Do XIRR Calculators Work?

XIRR calculators use an iterative approach to find the discount rate (annualized) that brings the Net Present Value (NPV) of all cash flows (inflows and outflows) to zero. Each transaction’s exact date is factored in, making it highly accurate for calculating returns from irregular investments.

XIRR Calculation Formula

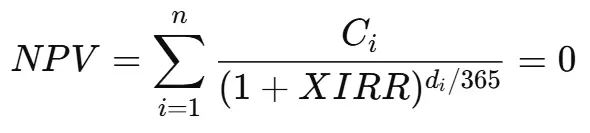

The XIRR formula is based on solving this equation:

Where:

- Ci: Cash flow at time i.

- di: Days between the cash flow date and the start date.

- XIRR: Extended internal rate of return.

Since this equation doesn’t have a direct solution, financial software or calculators solve it using trial-and-error or numerical methods.

Example of XIRR Calculation

Let’s consider the following cash flows:

| Date | Type | Amount (₹) |

|---|---|---|

| 01-01-2020 | Outflow | ₹200000 |

| 01-04-2020 | Outflow | ₹150000 |

| 31-03-2021 | Inflow | ₹100000 |

| 10-05-2022 | Inflow | ₹200000 |

| 15-10-2023 | Inflow | ₹120000 |

The XIRR for these cash flows, assuming today’s market value is ₹160000, will be calculated based on the exact dates and amounts.

Lets assume we calculated the XIRR on 07-05-2025, then XIRR calculated for this investment will be around 16.21% (Approx.). This means your investment grew at a rate of 16.21% per annum during the investment period.

How to Use Our XIRR Calculator

Our online XIRR calculator is built to handle a wide range of scenarios:

- Add Cash Flows: Add multiple rows with specific dates and cash flow values.

- Auto-Calculate: The calculator instantly evaluates and displays the XIRR when values are entered.

- Edit Anytime: Adjust inflows, outflows, or dates to analyze alternative scenarios.

- Delete Rows: Easily remove any incorrect or irrelevant cash flow entries.

Use it to assess:

- Mutual Fund SIPs

- SWP withdrawals

- Real estate investments

- Private business returns

Advantages of Using Our XIRR Calculator

- Accurate & Instant Results

- Considers Real Dates

- Mobile & Desktop Friendly

- No Sign-Up Required

- Supports Planning & Comparison

Additional Insights on XIRR Calculations

- Significance of Accurate Dates: The reliability of XIRR hinges on entering exact transaction dates — even minor errors can impact the result.

- Annualized vs. Absolute Returns: Knowing the difference helps you evaluate investments more effectively. XIRR offers the annualized return, which is better for comparing long-term investments.

- Enhancing Investment Decisions: Leverage XIRR to identify which investments are delivering the best performance within your Portfolio.

Understanding the Differences Between XIRR and IRR

While both XIRR and IRR are used to calculate investment returns, their applications vary.

IRR assumes cash flows occur at regular intervals and in equal amounts, making it ideal for structured projects.

XIRR, on the other hand, accommodates irregular cash flows and exact dates, providing a more realistic measure of performance in real-world scenarios like SIPs, SWPs, or varied capital inflows/outflows.

In summary, IRR is best for fixed-schedule projects, whereas XIRR is the preferred choice for dynamic investments that don’t follow a uniform timeline — making it highly valuable for personal finance and portfolio analysis.

Conclusion

XIRR is one of the most reliable methods to measure performance when your investment doesn’t follow a fixed pattern. Whether you’re a Financial Advisor, mutual fund investor, or a business owner evaluating cash flows, our XIRR Calculator Online helps you simplify complex returns.

Disclaimer: The content on this blog is intended solely for educational purposes. The results produced by the calculator or calculators are merely indicative and intended for informational reasons.

Under no circumstances should these calculators be regarded as financial, Investment or professional advice from Trustwell Finserve (“TWF”), nor are they intended to offer users certified results from TWF or to act as an obligation, guarantee, warranty, undertaking, or commitment. They are only instruments to assist users in analyzing different illustrative situations according to the information they enter. These calculators are used at the user’s own risk, and TWF assumes no liability for any mistakes, inaccuracies, or results that may result from using them.